For nearly two years, I have written about the decline in natural diamond prices. After rising to dizzying highs in 2021, natural diamond prices have seen a prolonged decline over the past two years. Whilst efforts by large Indian diamond manufacturers in late 2023 to curb the decline through a two month ban on diamond imports worked in the short term, with natural diamonds rising about three percent, they have since plateaued and have reverted back to their pre-moratorium prices. Whilst lower prices are great news for consumers, and in certain situations, good news for members of the trade, it is clear that the current slump is mostly caused by a lack of demand – as evidenced by the slump in sales from De Beers – the world’s largest diamond miner. Like most things in life, this prolonged decline isn’t due to one specific factor, but numerous factors occurring at virtually the same time.

Factor 1: A Good Old Fashioned Diamond Crash

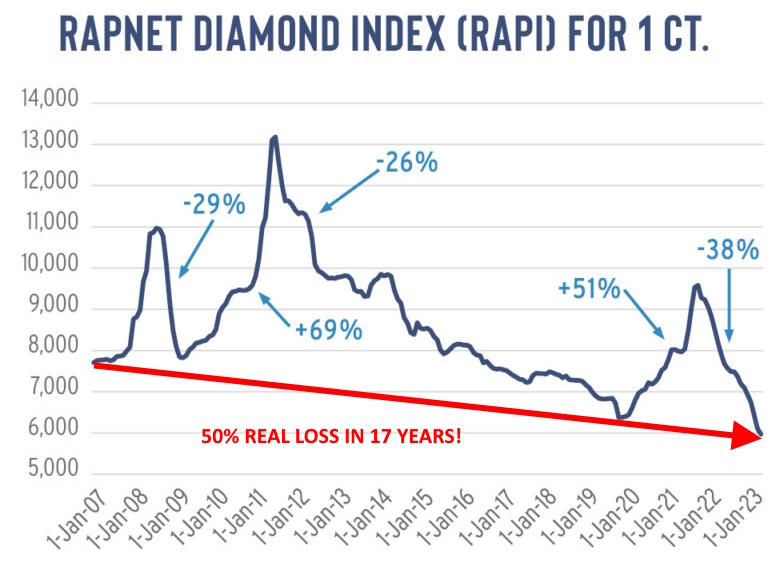

As mentioned previously, a diamond price bubble was created in 2021, only to be burst in 2022. As the graph below shows, price declines continued throughout 2023.

Above: Natural diamond price graph from 2007 to 2023. Source.

The problem with these boom and bust cycles is that the booms are driven solely by speculators, and not by actual demand. This creates an artificial bubble that quickly bursts and takes years, if not decades to recover from. In turn, this wreaks havoc for both the trade and consumers. Diamond traders, whilst they may make good profits during the boom are inevitably left with diamond stock that is overpriced, whilst consumer confidence is eroded when prices suddenly take a tumble.

Factor 2: Lab Grown Diamonds

It’s no secret that the rise in popularity of lab grown diamonds has taken its toll on the sales of natural diamonds. How much so is not known, and probably will never be known.

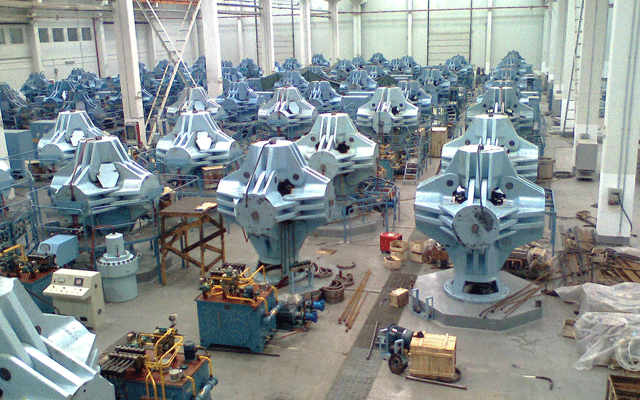

Whilst lab grown diamonds are not new – they have been around commercially for 20 or so years, the flooding of the market, mostly by Chinese companies, has meant that prices have plummeted, and their popularity has sky-rocketed. However, as I wrote in my last blog, consumers are getting wiser, and the shine is starting to tarnish on the “lab grown boom” due to falling prices. Whilst some may see this “pre-mature maturation” of the lab grown market as a boost for the natural diamond market, its effects will most likely be minimal and confined to the mid to high end of the market, with lower quality diamonds, such as those sold in chain stores, continuing to struggle.

Above: A Lab Grown Diamond Factory in China Producing a Seemingly Endless Supply.

Factor 3: The Covid Effect

It’s no secret that the pandemic lead to a drop off in the number of engagements and marriages. According to Signet, one of the world’s largest chain jewellers, the pandemic caused engagements to drop by 25%.

However, Signet’s chief financial, strategy, and services officer, Joan Hilson, then goes on to explain:

“We believe that engagements hit a trough in [the most recent] quarter”

Apparently Signet have a developed up to 45 metrics to predict when engagements will happen – such as a couple attending a concert together. According to the JCK article, using their definitely-not-creepy metrics, Signet expect engagements to remain lower than pre-pandemic levels for some time, but to start improving in 2024. Furthermore, despite all the talk that millennials and generation-Z are not getting married, Hilson states:

“In our research and surveys, nearly 80% of nonmarried millennials and Generation Z adults want to get engaged”

Above: A Couple at a Concert – A Precursor to Marriage?.

Factor 4: Sluggish Demand from China

20 years ago, diamond demand from China would have been a non-story. Nowadays, as the world’s second largest economy, China has considerable influence on the price of almost all goods traded around the world – including diamonds. With China’s economy sluggish, diamond jewellery sales have taken a hit, with Hong Kong based chain jeweller Luk Fook reporting a 35% decline in diamond sales.

Given that China only exited their Covid lockdowns in early 2023, it may be too early to judge whether or not demand will pickup to pre-pandemic levels or remain lethargic.

Above: A Luk Fook Store in China

Factor 5: The Rise of Gold

One of the more interesting takeaways from the Luk Fook financial reports was that sales of gold jewellery increased by 23% in mainland China, whilst diamond set jewellery sales decreased by 35%. Indeed, in many Asian countries, consumers buy jewellery based on the perceived present and future value.

With much of the potential customer base put off by the volatility and lack of growth prospects for natural diamonds, it is no wonder that natural diamond demand has slumped.

Above: Gold and Gold Jewellery are Proving to be a Safer Bet than Diamonds.

It is clear that whilst the natural diamond industry is recovering from the pandemic induced malaise and the excitement over lab grown diamonds, the industry still has issues to resolve. After many economic cycles, those that blame macro-economic factors such as high interest rates and inflation begin to sound like a broken record when the same issues arise time and time again. My prediction is that whilst demand will pickup in the coming year or so, prices will remain subdued, possibly rising a few percent, but definitely not to pre-pandemic levels, which would need a rise of about 12 percent. However, as has been shown in the past, seems to be a fool’s game.

July 21st, 2024 at 7:55 am

I have spent the last 50 +

Years Mining/ Dealing and Supplying World Markets in Diamonds, Yes there is definitely a great future in the Natural Diamond Trade Worldwide as Natural Diamonds are definitely Real and Natural and not just made in a Machine, and are the Real Sign of Real

and Lasting Love, from my experience young ladies definitely want the Real Diamond, and definitely not a man made diamond, Ladies always need to feel Special, Needed and Worth It, This is because that the Very Established Diamond Mining Corporations definitely needs to get their Act Together, They need to get real Confidence back into their Product and stop thinking that business is going to fall into their laps. It is as simple as that, Natural Diamonds are by Far the best Quality Life Changing Gift that a Man Can Give to his Fiancé. The Very Big Diamond Mining Corporations Needs to Reboot it’s business going forward, it’s as simple as that.