Every so often, especially on online forums such as Reddit, the topic of diamonds comes up and inevitably a response is garnered along the lines of “Diamonds aren’t rare! They’re a scam!”. Whilst the simple fact of the matter is that diamonds are in fact not rare at all, gem quality natural diamonds are in fact rare, especially large ones with minimal hue and imperfections. Whether they are a scam or not really is up to the individual to decide, but at the end of the day, no one is really forcing people to buy diamonds or diamond jewellery. This “anti-diamond” attitude has its roots in the late Edward Jay Epstein’s book The Rise and Fall of Diamonds which was first published in 1982. However, more than 40 years later, a lot of people are still parroting the same lines published in the book, seemingly oblivious to modern-day reality.

The DeBeers Cartel

By now, pretty much everyone knows the story of how diamonds and diamond jewellery became popularised in the second half of the 20th century. The aforementioned book, The Rise and Fall of Diamonds goes into great detail about the goings-on of DeBeers during those years, and Epstein even went as far as saying:

“The invention is far more than merely a monopoly for fixing diamond prices; it is a mechanism for converting tiny crystals of carbon into universally recognized tokens of power and romance.”

The two fundamental assertions Epstein makes are that diamonds are not rare due to the fact that DeBeers controls supply, and that diamonds are as popular as they are today due to DeBeers’ marketing campaign. Whilst the latter assertion may be true – Epstein goes into great detail about DeBeers’ marketing campaign, whose slogan, “A Diamond is Forever” became one of the recognisable slogans in advertising history, the first assertion, that diamonds are not rare, simply isn’t true. The fact is, high quality, natural diamonds, especially large ones are extremely rare, and are priced as such. The real question is, had it not been for DeBeers’ stranglehold on supply, would the diamond industry, made up of many players in the mining sector, a) been able to orchestrate such a comprehensive marketing campaign, and b) been able to artificially inflate prices, and exactly what effect this would have had on prices downstream? Judging by the state of today’s industry, the answer to those questions are a) a resounding no, the industry probably wouldn’t have been able to agree on the best way to paddle a canoe, and b) yes, one company controlling diamond supply had a huge impact on prices.

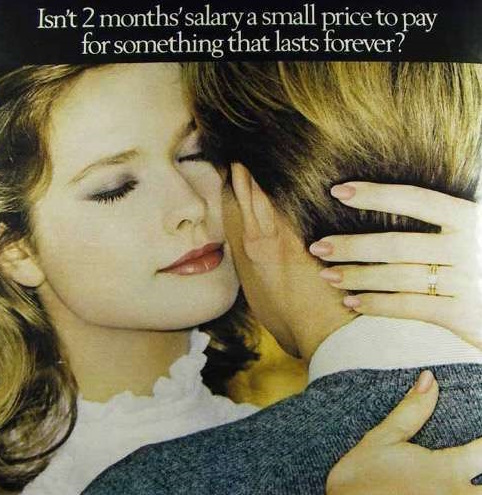

Above: The “Two Months Salary” line used heavily by De Beers.

The Diamond Industry Today

If I could think of one word to describe today’s industry it would be fragmented. Gone are the days of DeBeers being a monopoly and controlling supply. Whilst DeBeers, and its joint venture with the government of Botswana, Debswana still is the largest diamond miner in the world, there are a plethora of smaller diamond mining companies operating in countries such as Canada, Namibia, Angola and South Africa, not to mention DeBeer’s main competitor – Russia’s Alrosa, who are currently under sanctions from many western countries. The current diamond price slump pretty much puts to bed any assertion that any sort of monopoly exists in the rough diamond sector, with many diamond miners experiencing reduced profits or even losses, lower production numbers and lower prices due to falling demand over the past two years.

Above: The notorious De Beers shoe box is still around, but not as relevant as it used to be.

Likewise, on the manufacturing side, there are a handful of large companies that control a large market share, alongside a large number of smaller manufacturers. In recent years, the diamond industry has moved toward commoditisation, leading to increased efficiency and price transparency.

One therefore has to wonder what a book about the inner workings of the diamond industry would look like today? Would the writer reveal an industry in turmoil, plagued by falling demand, smaller profits, and worst of all, the alarming rate of suicides in the industry?

The New DeBeers?

The rise of lab grown diamonds has inevitably spawned a new breed of retailer – one that sells lab grown diamonds only. Buoyed by unfounded claims of being more ethical and better for the environment than their natural counterparts, their marketing claims sure would have made the 1950s DeBeers marketing firm NW Ayer gasp in awe. Heck, one of them even managed to be successful on Dragons’ Den.

Whilst I am not against lab grown diamonds – I sell a lot of them myself and see a bright future for them along side natural diamonds, I can’t help but notice that every single retailer that sells lab grown diamonds exclusively both repeats that same marketing claims, whilst applying a huge markup to their diamonds and jewellery. The huge markup made by lab grown retailers spawned a huge debate last year on LinkedIn, sparked by a post by Garry Holloway, with industry heavy weights such as Martin Rapaport weighing in.

Whilst I have no qualms about retailers overcharging unsuspecting customers, as less than a minute on Google would reveal many sellers with much better prices, I can not help but to draw parallels with how lab grown diamonds are marketed by some in the industry, and with how DeBeers marketed diamonds in the 1950s and onwards. Unfortunately for the lab grown diamond industry, any hopes of lab grown diamonds becoming, as Epstein puts it, “universally recognized tokens of power and romance” have pretty much been dashed, as prices have come down to a point where they are more suitable for fashion jewellery, not to mention that most retail jewellers are now selling them without sprouting these false claims, and merely as a more affordable alternative to natural diamonds.