As the slump in the natural diamond industry enters its fourth year, one has to wonder when, and even if, things will get better for an industry that has been battered from lower demand due to increased competition from lab-grown rivals and overall lower consumer demand, most notably in China. Unfortunately, if the past 25 years are anything to go by, it would seem the malaise is here to stay, essentially creating a “Diamond Doom Loop”.

What is a Doom Loop?

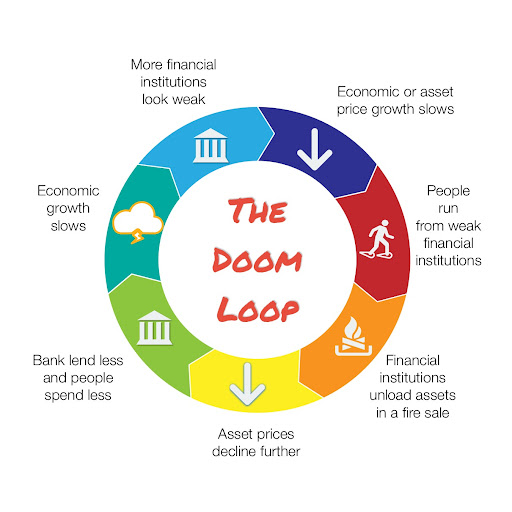

Investopedia describes a Doom Loop as:

“A doom loop describes a situation in which one negative economic condition creates a second negative condition, which in turn creates a third negative condition or reinforces the first, resulting in a downward spiral.”

Above: How a Doom Loop Works.

The Urban Doom Loop

In 2022, Stijn Van Nieuwerburgh coined the phrase “urban doom loop”, referring to the fact that remote work has reduced demand for office space, making it less valuable, leading to less taxes paid to the city council which in turn makes the city a less attractive place to live.

Whilst many city centres around the world have been struggling due to high office and retail vacancy rates, San Francisco has garnered much of the attention, most likely due to its rapid fall from grace and lack of political leadership.

The Diamond Doom Loop

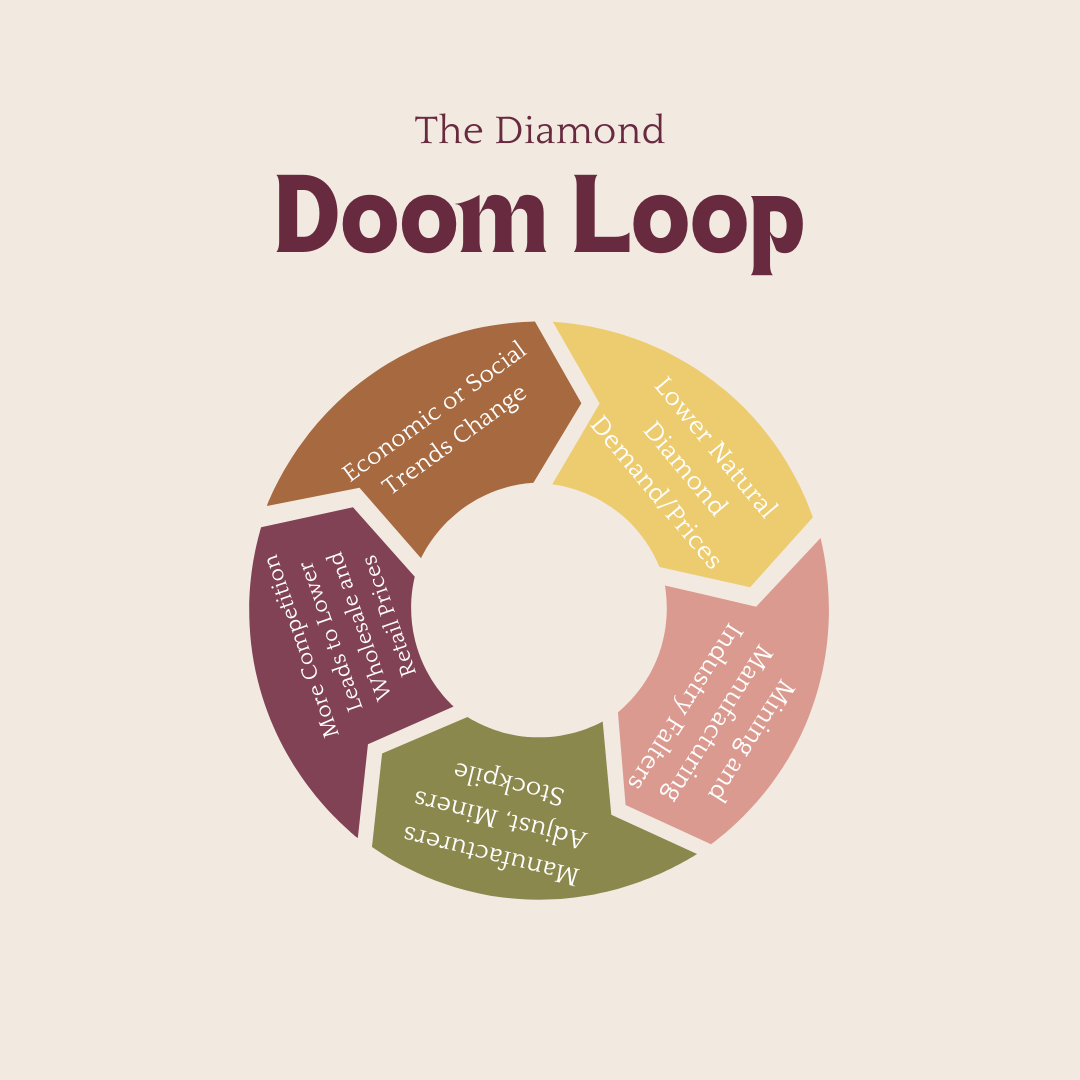

The diamond doom loop describes what happens to the diamond industry when major changes, whether societal or economic changes occur.

Above: The Diamond Doom Loop.

Essentially, when societal or economic changes occur, such as the rise in popularity of lab grown diamonds or China’s economy faltering, natural diamond prices will inevitably fall. This leads to both the mining and manufacturing faltering and having to reduce operations, lay-off staff and even suspend mining operations altogether. However, eventually manufacturers will adapt by reducing staff counts and, as is the case more recently, move into manufacturing lab grown diamonds. Likewise, miners will adapt by simply reducing operations and stockpiling rough. However, eventually, with supply virtually flooding the market due to increased competition on the manufacturing side, both wholesale and retail prices fall even further. Eventually, the loop starts again, possibly after a short “bubble” period where prices are artificially inflated by speculators, and the cycle repeats.

How to Fix It

Whilst the current situation is no doubt miserable for many, it should be noted that the whole diamond industry has been experiencing some degree of malaise ever since the global financial crisis in 2008, when prices cratered, virtually overnight. We then saw bubbles in the early 2010s and 2020s, which were merely “interruptions” to this malaise.

In a recent IDEX memo, John Jeffay alludes to a McKinsey article that presents three possible outcomes for the diamond industry:

- Lab-growns become the norm. They take over the majority of the market. Natural diamonds become a niche luxury, like collecting classic cars.

- Lab-growns become so cheap that they effectively become fashion accessories and no longer compete with natural diamonds.

- Diamonds go out of fashion because consumers can’t tell the difference between lab-growns and natural stones. Diamonds lose their appeal, and are no longer seen as a must-have for engagement rings.

Whilst I doubt the last outcome will occur, I do think either outcome one or two, or a combination of both will occur. Perhaps in the short term, outcome one – lab-growns dominating the market, whilst natural diamonds are reserved for those that appreciate them is a more probable outcome. However, just like other synthetic gemstones such as moissanite, the price of lab-grown diamonds will eventually fall to the tens of dollars per carat, which will essentially relegate them to the fashion jewellery market, leading to outcome two. Whilst I have previously written that this will happen much sooner than later, it seems that the lab-grown market is hanging in there, and in some respect, riding the coattails of natural diamonds, using the same grading scale and certificates as natural diamonds, despite being worth less than 5% of their natural counterparts.

So far, the natural diamond industry has been relatively mute in regard to the happenings within their own industry. Two ways to drive up demand for natural diamonds put forward are:

- An increase in traceability – the aforementioned McKinsey article states that 20-30% of fine jewellery purchases will be influenced by sustainability this year. Furthermore, DeBeers are using their Tracr for all diamonds above 1ct.

- Industry supported advertising – Essentially, a return to the “good old days” where DeBeers, through the Diamond Promotion Service (DPS), promoted diamonds to the world, and we all paid for it, as DeBeers was the monopoly.

Whilst these are positive steps, I really don’t think either of these initiatives will be enough to move the needle in any significant way. Indeed, I think the fortunes of the diamond industry are more tied to external factors that no one in the industry can control, such as trends on social media, changes in disposable incomes and the economic fortunes of countries like China.