As I have written many times before, the price of lab grown diamonds is crashing. Whilst this is great news for consumers, many in the industry, including myself have been taken by surprise by the rapid rate of decline of lab grown prices. Whilst most in the supply chain, including manufacturers, wholesalers and retailers will see out this “lab grown craze”, the fact is, many companies will struggle financially when lab grown diamond prices hit rock bottom, and the lab grown industry matures and gravitates toward the more popular low-end and fashion jewellery market.

Cost of Producing Lab Grown Diamonds

As I stated earlier, many in the industry have been taken aback by the pace of price declines. However, once you realise the cost of producing a lab grown diamond, some may say that they are currently over-priced and they need to go down further.

There are three main costs involved in producing a lab grown diamond:

- Growing the rough: This has been the main driver of price declines. It’s no secret that both Chinese and Indian growers are flooding the market, reducing the cost of rough to the tens of dollars per carat.

- Cutting and polishing: The cost of polishing has come down, albeit in the last decade or so. Depending on the polishing factory, costs generally range between US$10 and US$50 per carat.

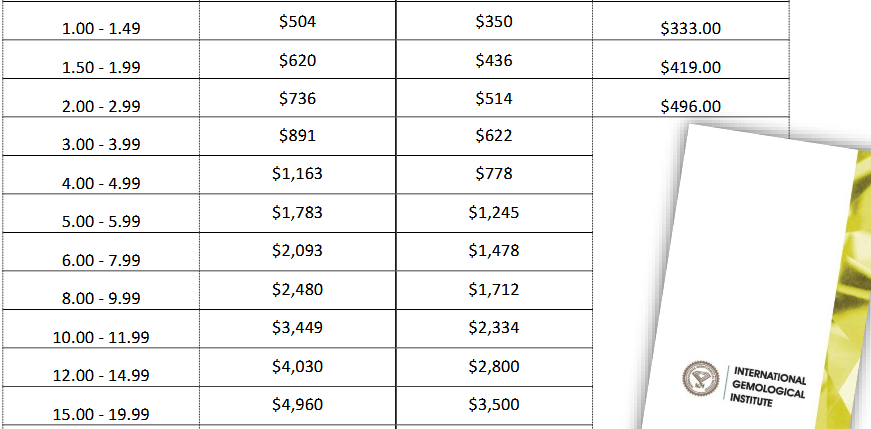

- Independent Certification: Lastly, certification costs from IGI are generally about US$25-30 per carat.

Above: A sample of IGI fees in Hong Kong Dollars.

Putting all these costs together, it is clear to see that the average cost per carat comes out to well under US$100 per carat. Given this, we may soon be seeing retail prices of around US$200 per carat become the norm for high quality, say F/VS1 lab grown diamonds.

De-Coupling Needed

I firmly believe that a de-coupling of natural and lab grown diamonds will be mutually beneficial for both natural and lab grown industries, as when it comes down to it, they are now worlds apart in terms of pricing. There are three things that will help de-couple the two industries:

- Stop using the Rapaport price list for lab-growns: The Rapaport price list, whilst some swear by it and others hate it, is nowadays mostly used in the industry for price movements. Heck, Rapaport could use a random number generator for his price list and it would still be just as useful. It makes even less sense when used for lab grown diamonds as the price discounts are non-sensical.

- Stop sending them for independent certification: Independent certification is obviously not viable if it constitutes one third, or even half of the cost of producing the diamond. Moreover, most consumers won’t care about the certificate if the diamond costs under $300.

- Stop treating them like individual diamonds: When lab grown diamonds are being sold for less than $100 per carat, it will simply be uneconomical to detail every single characteristic of every single diamond. Thus, they will be sold like melee (below 0.20ct) diamonds are currently purchased – in parcels of many carats and loosely graded.

Above: A Youtube video with analysis of a lab grown diamond. Such detail is a bit over-kill nowadays.

The Potential Casualties

When lab-grown diamonds finally step out of the shadow of their natural counterparts, we are likely to see a lot of businesses financially struggle. These include:

- Retailers Who Bet Big on Lab Grown Diamonds: Any small to medium retailer selling lab grown diamonds exclusively for made to order jewellery such as engagement rings will soon see their turnover and profitability shrink due to the massive price declines and the overall decrease in popularity of lab grown diamonds for engagement rings. Whilst bigger chain stores won’t be affected as much as their jewellery is mostly off-the-shelf and usually marketed toward the low end, many of these “lab grown only” retailers, who have been reaping massive margins in the past few years, will find it difficult to sustain a bespoke jewellery model when the most expensive item you are selling is in the ballpark of $2,000.

Above: A meeting of lab grown diamond retailers.

- Lab Grown Certification Labs: Obviously when the market realises that independent certification of lab grown diamonds is not viable for a product worth a couple of hundred dollars, any laboratory that certifies lab grown diamonds will have their business evaporate. Funnily enough, I believe Blackstone, the owners of IGI, the largest certifier of lab grown diamonds, see the writing on the wall, and hence are planning a US$300 million IPO in order to dispose of at least part of the company.

- Diamond Aggregators: In my last blog, I wrote about diamond aggregators such as Nivoda challenging the traditional supply chain and providing a link between manufacturers and retailers. However, based on anecdotal evidence, and speaking to others involved in this space, these diamond aggregators are very much “lab grown heavy”, with the majority of their business made up of lab grown diamonds. This makes sense, because the lab grown market is very fragmented, with hundreds, if not thousands of small manufacturers, whereas the natural diamond market is very much concentrated within a small group of large manufacturers. Whilst these diamond aggregators currently provide a great service, allowing retailers to buy the best quality and the best price, when the lab grown market matures, the need for these services will severely diminish, as lab growns will be bought in parcels, much like melee (below 0.20ct) diamonds are currently purchased, with minimal price variations between manufacturers. Hence, retailers will just as easily be able to deal directly with the manufacturer. Funnily enough, Nivoda have just released a puff piece stating that lab growns experienced “a recent upward trend in Q1 2024 “, something that is blatantly false. Are they trying to delay the inevitable?

- Any non-Indian or non-Chinese manufacturer: People like to say that countries such as India and China can achieve low manufacturing costs due to the cost of labour. Whilst this may be true, they are also good at achieving economies of scale, as well as having the manufacturing support and low energy costs that Western countries lack. Already we have seen US-based manufacturer WD Lab Grown Diamonds file for bankruptcy, and I would imagine most other diamond growers in the West will follow suit.

Whilst the lab grown diamond industry has been incredibly popular over the past three to four years, the market is maturing a lot faster than most people have expected. This has caused many jewellers, wholesalers and diamond manufacturers to re-assess their business models. However, it is clear that amongst all the hype of the last few years, some businesses will simply not be viable.