Earlier in the year, I wrote about how sanctions on Russian originated diamonds wouldn’t work. Since then, both the World Diamond Council (WDC) and the Belgian government have released plans to identify and ban Russian originated diamonds, with the aim of convincing The Group of Seven Countries (G7) to implement sanctions on Russian originated diamonds, even if they have been cut and polished in another country, such as India.

Competing Plans

Both plans from the WDC and Belgian government are vastly different. Firstly, the plan from the WDC seems like they have just copied and pasted the The Kimberley Process. Essentially every supplier in the supply chain, whether they be rough diamond dealers, polishers or retailers will have to include a declaration on every invoice stating that the diamond, whether rough or polished do not originate from Russia. In addition to this, there would be “assurance bodies” established, who would verify these declarations and possibly do “regular spot checks”.

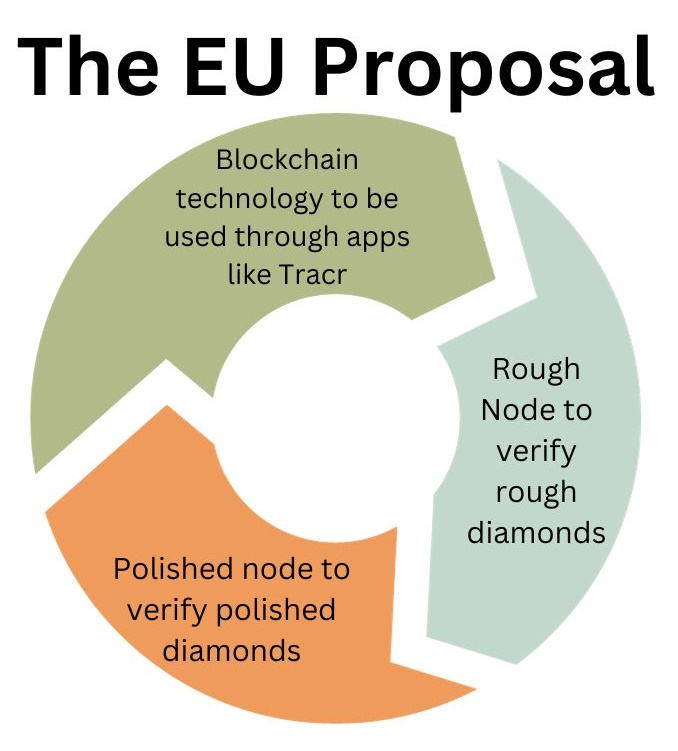

Conversely, the plan from The Belgian government, also called “The EU Proposal” is much more complex. Firstly, it requires diamond traders to verify the declarations with existing technology such as Tracr or GIA’s Diamond Origin Report. Secondly, prior to be polished, all rough diamonds must go through a “rough node” to be verified and then after polishing pass through a “polished node” to be verified again.

Above: Overview of The EU Proposal

Both Plans Suck

Unfortunately, both plans put forward are deeply flawed. Firstly, the WDC plan, like The Kimberley Process it is based on lacks any proper enforcement. The fact that anyone can just state the diamond that they are selling doesn’t come from Russia really doesn’t do much if it can not be verified either way. In addition to this, diamond tzar Martin Rapaport has expressed concerns over the fact that auditing and compliance costs may be too burdensome for smaller miners and diamond polishers, thus increasing the market share of larger diamond miners and diamond polishers.

Above: Diamond Tzar Martin Rapaport

Conversely, The EU Proposal, whilst very detailed, seems way to complex and costly for the entire industry to participate in. In my opinion, a plan, implemented in its entirety is mere “pie in the sky” thinking.

Ideally, any plan to implement sanctions on Russian originated diamonds should include and be able to be implemented by all industry participants, from large miners and diamond polishers, to small jewellery retailers. Unfortunately it seems that the two plans currently being put forward have been devised by “the big end of the business”, without much regard for smaller players, creating a huge problem in a highly fragmented industry such as the diamond industry.

It All Comes Down to India

As the country that polishes an estimated 95 per cent of diamonds, India is critical to implementing any sanctions on Russian diamonds, as quite simply, they are the conduit between Russian originated diamonds and Western consumers. However, it has become quite clear that India will not be implementing any sanctions on Russian diamonds, due to the fact they export to many countries that haven’t taken a side in the Russia-Ukraine conflict.

In a bit of wishful thinking, those looking to implement sanctions on Russian diamonds think that the Indian polishing industry will separate Russian rough from non-Russian rough. This, on the same week that one of the largest diamond manufacturers in the world, Shree Ramkrishna Export, were labelled as “international sponsors of war” by the Ukrainian government for importing Russian rough diamonds – a claim that they refute. It is therefore blindingly obvious that India, through better or worse, can not and will not be playing ball in terms of diamond sanctions with either the WDC, G7 or any other Western country.

Above: Headquarters of Diamond Manufacturer SRK.

Will Sanctions Really Matter?

As I wrote about earlier this year, even if the G7 and all other Western countries implement a perfect system that effectively sanctions 100 per cent of all Russian diamonds, there are still no shortage of countries, most notably China, who are willing to allow Russian originated diamonds to be imported and sold. Therefore, the sanctions may very well have the opposite effect of their intentions, as Western diamond consumers will pay more for the added bureaucracy, whilst diamond consumers in other countries will buy Russian originated diamonds at a lower cost.

Above: A Chinese Jewellery Store – Obviously Very Worried About Russian Sanctions.

In addition to this, there is some chatter in the industry that the natural diamond industry is shrinking due to the rapid rise in popularity of lab grown diamonds. If this turns out to be true, then there is a possibility that the entire industry may naturally shift away from Russian originated diamonds due to public perception of the industry.

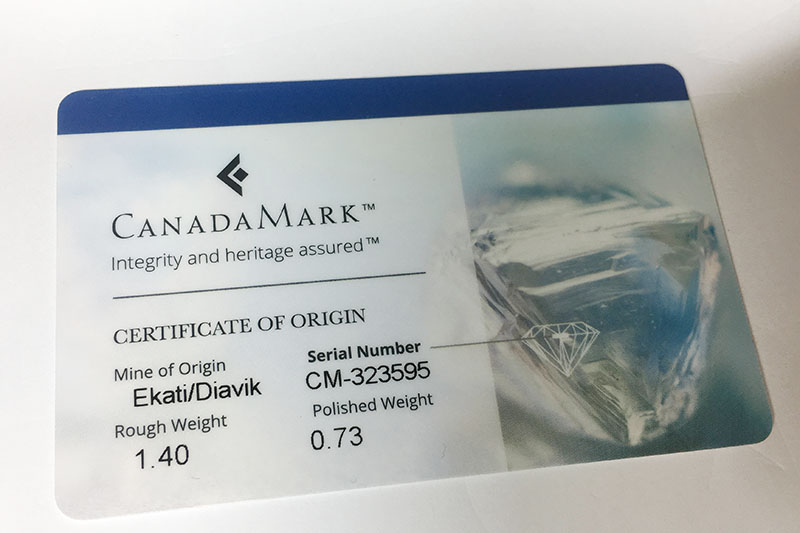

Time for The Industry to Get Serious About Country of Origin

Country of origin certification has been around for many years. Most long-established Australian jewellers were introduced to it in the 1980s when Argyle started marketing diamonds from their mine. It peaked around 2006 when the movie Blood Diamond was released, however, it never really gained traction from within the industry. My thoughts on country of origin are that whilst I don’t think it adds much in the way of monetary value to a diamond, it is an excellent way to promote an ethical industry and attract ethical consumers, especially in the wake of the Russia-Ukraine conflict and the so-called “lab grown threat”.

Above: A Canadamark Certificate.

However, I think the diamond industry has really missed a trick over the past 18 months by not implementing some sort of widespread industry country of origin certification. Whilst some large diamond manufacturers do state the origin of individual diamonds, and there are programs that promote the positive effects of the industry such as Diamonds Do Good, an industry wide country of origin certification process would really empower end consumers to make better decisions.