Last week, I wrote about how despite dubious claims made by lab grown diamond sellers, that on the whole, lab grown diamonds look better and are a lot cheaper than their natural counterparts. These two factors, combined with a flood of supply bringing prices down, has meant that lab grown diamonds now account for roughly 40 per cent of the engagement ring market. So, with the meteoric rise of lab grown diamonds mean the end of natural diamonds?

The Attraction of Natural Diamonds

Whilst some people may say they like natural diamonds simply because they come from nature and are formed below the earth’s surface over billions of years, the main attraction with natural diamonds is their rarity, and hence value. When it comes to engagement rings, this rarity and value ultimately becomes a form of dowry, or as diamond tzar Martin Rapaport puts it: “if you want to have children, you need financial and emotional security”, with a natural diamond providing this security.

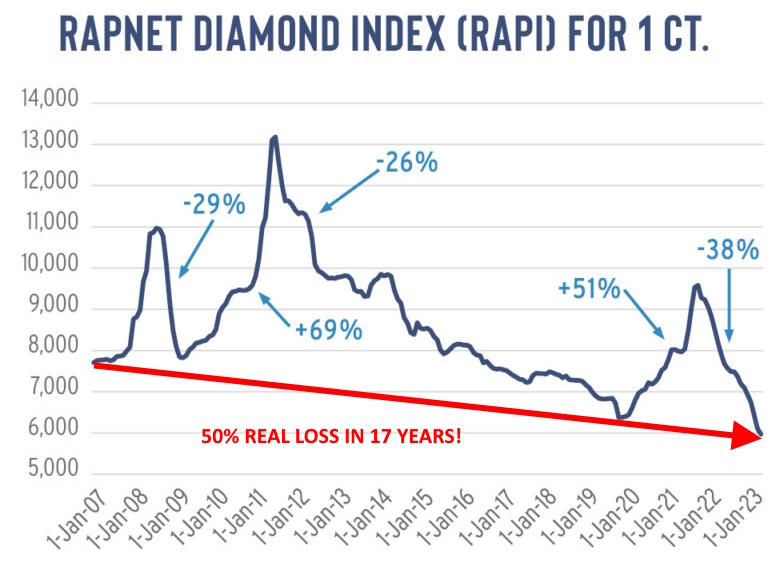

However, if you look into the last 17 years of natural diamonds, you will notice two things:

- The average price of a 1ct diamond has slowly gone down, from just under US$8,000 per carat to under US$6,000 per carat. In real terms, this represents a 50% decrease in value over 17 years.

- There are price spikes, fuelled by speculation within the industry, followed by rapid declines every so often.

Above: Natural diamond price graph from 2007 to 2023. Source.

These two points certainly do not represent something that provides “financial and emotional security” as Mr Rapaport states, moreover, they look more like a depreciating asset, where if you’re unlucky enough to buy at the wrong time, you may just lose 50% of your money within a few months. In fact, as the table below shows, in financial terms, you may well be better off buying a lab grown diamond.

Above: A financial comparison between lab grown and natural diamonds.

Natural Diamonds: From Mainstream to Niche Market?

For almost 100 years, the diamond engagement ring has been the most popular form of engagement ring, with most attributing this to marketing by De Beers. However, one only has to look at other gemstones such as rubies or emeralds to see a possible future for natural diamonds. Despite both synthetic rubies and emeralds being widely available for decades, the price of both natural rubies and emeralds has increased. However, the fact remains that, outside of diamonds, the fine gemstone market remains comparatively small. With lab grown diamonds slowly encroaching on natural diamonds’ market share, one has to wonder if natural diamonds will go from a mainstream to niche product, and perhaps, go from being a depreciating asset to a good investment.

Reforms Needed

Lab grown diamonds have provided the natural diamond industry its first major competition in nearly 100 years. Most in the industry were left blindsided by the sudden flood of supply of lab grown diamonds back in 2021, causing the price of lab grown diamonds to crash and their popularity to boom. However, this sudden popularity of lab grown diamonds has highlighted the need for reforms in the natural diamond industry in order to have any chance against the new competition.

Stamp Out Inefficiencies

The natural diamond supply chain is full of inefficiencies. Avi Krawitz, writing for Rapaport, points out that the rough market rarely produces the desired outcomes to meet polished demand. That is, the old “shoebox” of rough diamonds from De Beers that diamond manufacturers receive every month or so, is horribly outdated and in desperate need of reform. Another inefficiency, as I pointed out, in 2007, is that of diamond consignments or diamonds “on memo”. This is where retailers, rather than buy diamonds, are essentially loaned them to display in their stores. This usually adds a significant amount to the cost of the diamond, far exceeding the cost of finance from say a bank or other lending institution. However, if you look at the lab grown diamond industry, you will see these inefficiencies either don’t exist or are very minor, meaning it is an issue the natural diamond industry must address.

Above: The notorious De Beers shoe box of diamonds.

Stop Bad Certification

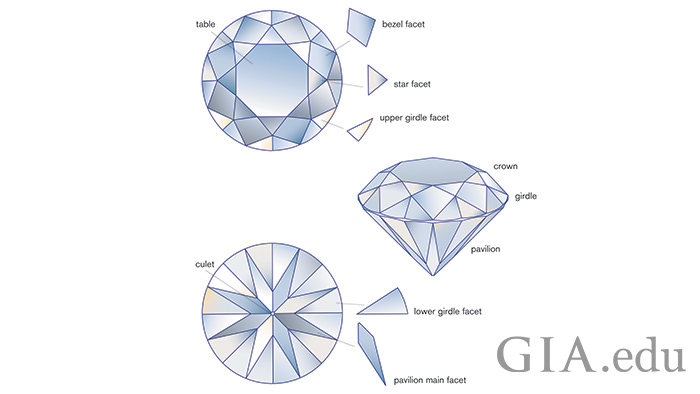

The quality of a diamond, as determined by the 4Cs ultimately determines its value. Small, microscopic factors can have a huge impact on the end value. Unfortunately, whilst GIA are considered to be the gold standard in diamond grading (at least in colour and clarity), it is well known that many grading labs inflate their grades in an attempt to increase the diamond’s value. For its part, GIA may be just as bad, as their excellent cut grade is bordering on ridiculous, as round diamonds with a 64% or more depth earning the top “excellent” grade. Whilst this isn’t a problem exclusively for natural diamonds, the value of lab grown diamonds make these grading “indiscretions” a non-issue.

Above: It is almost laughable that GIA goes into such detail to describe their flawed cut grading system.

Get Serious About Country of Origin

As I’ve said before, for the past 20+ years, the diamond industry has drifted from one conflict or crisis to another – whether it’s a dictator in Zimbabwe, or a dictator in Russia. For most products, the origin of the raw material is seemingly immaterial. In fact, many products have extremely questionable supply chain ethics, such as chocolate, fast fashion or even solar panels – but still, most people buy these without so much of a thought as to how or who manufactures them. However, for a purchase as important or emotional as a diamond engagement ring, these things do matter to a lot of consumers. That said, will a bride in China care if her diamond comes from Russia? Probably not, and nor will the vast majority of Western consumers. However, a growing cohort of consumers do, and the relative ease as to which a country of origin system could be implemented, or the relative low cost of using existing systems such as Tracr, almost makes it a no-brainer.

Above:Even food has detailed country of origin labels!

Ultimately, no one can predict the future. Last year, I predicted that lab grown diamonds will be relegated to the lower end of the diamond market, fashion jewellery and a whole host of other uses. Whilst that will most likely eventuate, it remains to be seen whether the natural diamond market will regain their popularity or be relegated to a high end niche market.