This past week, diamond tzar Martin Rapaport came out and accepted defeat in the war on lab grown diamonds. In his latest editorial, he states that the current slump in natural diamond demand is due to, amongst other factors, “synthetics replacing natural diamonds” and that “These changes are fundamental and long-term. Business will not return to normal.”. He then goes on to blame jewellers selling lab-grown diamonds for causing such “damage”, seemingly oblivious to fact that most jewellers are simply selling what their customers want, and in some cases to just stay in business. Whilst Rapaport is right about the diamond industry having changed fundamentally, it really should be a wake up call to the natural diamond industry to pull their proverbial socks up. Unsurprisingly, the industry has very much been “all talk and no action” in the face of the worst crisis the diamond industry has faced in modern times. Whilst reducing supply is a good start, the natural diamond industry must now focus on increasing demand and stop crying over spilt milk. Whilst this is no doubt a difficult task, below are a few suggestions.

Go After Lies Pedalled by Lab-Grown Charlatans

It’s no secret that much of the recent success and growing market share of lab-grown diamonds is due to the price of them. Natural diamonds that cost tens of thousands of dollars have lab-grown counterparts that can now be purchased for hundreds of dollars. However, a common marketing line used by those selling lab-grown diamonds exclusively is that diamond mining is extremely bad for the environment and unethical, due to amongst other things, exploitation of workers. Whilst there are isolated cases in which these statements are true, painting an entire industry as evil is surely libellous, and coming from competitors of the natural diamond industry most likely breaches trade practices or competition laws in several countries. It therefore should be a no-brainer for groups such as The Natural Diamond Council (NDC) to pursue legal avenues against these charlatans who repeat such lies.

Above: Birds get dirty and are scared by explosions due to diamond mining, hence you should buy a moissanite.

Help Accelerate the Inevitable Price Decline and Decoupling of Lab Grown Diamonds

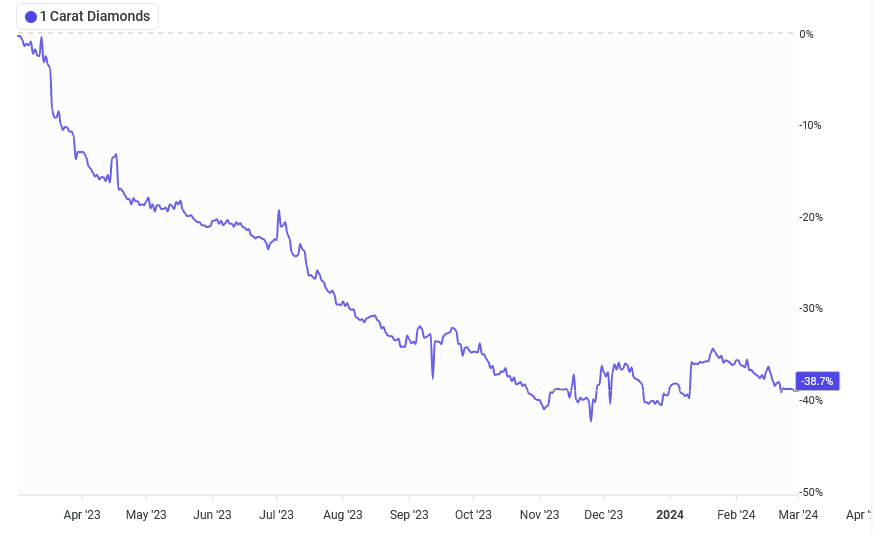

It is clear that lab-grown diamonds have been in a price freefall over the past few years, and that this will continue until they hit rock-bottom, which in my opinion is about US$50 per carat for even the best quality ones. At this price point, even with wholesale and retail markups, consumers will view them much the same as other synthetic gems such as moissanite. Whilst this may seem counter-intuitive, jewellers who sell lab-grown diamonds at what they are worth, that is, without inflated markups, but still with a tidy profit margin, are actually helping accelerate the inevitable decline of lab-grown diamonds into the realm of low-end and fashion jewellery. This is because they expose consumers directly, without any bias, to the value of lab-grown versus natural diamonds. On the production side, natural diamond manufacturers who have “lab-grown side hustles” must also help de-couple lab-growns from naturals by doing away with independent certification and even the GIA grading scale for lab-grown diamonds.

Above: 1ct lab grown prices from March 2023 to March 2024. Source.

Start Marketing Natural Diamonds as Rare

In March 2024, The NDC launched a campaign titled “Real. Rare. Responsible.” Going by the title of the campaign, it may seem like this is a step in the right direction. However, a quick glance at their campaign website shows that there is nothing of substance to convince the would-be diamond buyer to choose a natural diamond over say a lab-grown diamond, or that their would-be purchase is actually valuable, and not a complete waste of money. Rather than emphasise things that consumers care little about, such as “responsible environmental practices” and other such buzzwords, natural diamonds should primarily be marketed as rare – and that is why they are priced as such. Whilst most jewellery consumers understand the value of a precious metal such as gold, most would struggle to provide a coherent answer as to why a one carat E/VS1 ideal cut round brilliant is priced the way it is. Again, it is a no-brainer that The NDC should launch a campaign that educates consumers (and the trade) as to the rarity of high-quality large diamonds, explaining how and why these diamonds are priced the way they are.

Above: The classic DeBeers shoebox of rough diamonds, but how many produce 1ct, 2ct or 3ct polished diamonds?

Make Diamonds Look Great Again

Over the past 20 years or so, diamond manufacturing has seen the emergence of a high level of automation. Gone are the days of a “master diamond cutter” producing a beautiful diamond. Nowadays, most of the planning and cutting of a diamond – from rough to polished is done by machines. This has led to better yields, but at the cost of beauty, with GIA willfully encouraging manufacturers to produce badly cut diamonds. However, there is no reason why the industry can’t step back from optimising rough yields to optimising beauty. A good start would be for the GIA to introduce their recently acquired AGS light performance grading and apply it as standard, thus doing away with their god-awful cut grading system.

Above: Martin Rapaport’s new red hat?

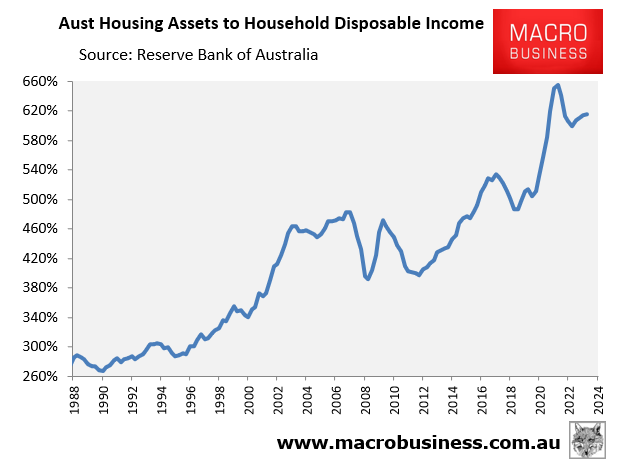

Support Government Polices That Reduce the Cost of Housing

It’s no secret that housing prices have increased substantially over the past twenty years. In Australia, things have gotten so out of control that there has been talk of 50-year mortgages. Whilst Martin Rapaport writes that retailers are the ones convincing young couples to spend less on their engagement rings, it is clear that young couples, faced with crippling housing debt, need very little convincing to spend less on their engagement rings.

Above: Australian House Prices Relative to Disposable Income. Source.

Ever since DeBeers marketing campaigns in the mid-to-late 20th century, the diamond industry has been albeit void of anything that actually increases actual, not speculative demand. With demand seemingly at an all-time low, now would be a good time to change course and at least try to stimulate demand.