Last month, Joshua Freedman of Rapaport released a video detailing his experiences going “undercover” with three high end boutiques in Las Vegas. The three boutiques were Tiffany, Van Cleef and Arpels and Cartier. Although Joshua seemed happy with the salespeople at two of the stores, it seemed one of the store’s salesperson wasn’t up to scratch. However, one thing they all had in common was to rely heavily on GIA certification, and as Joshua stated:

“There was also a tendency to rely on the GIA – rightly or wrongly – as the answer to all questions about product verification.”

This begs the question – has GIA turned the entire industry into “NPCs” (Non-Playable Characters) who are simply hawking pieces of paper, rather than selling diamonds and jewellery?

A Brief History of Diamond Certification

Although GIA started issuing diamond certificates in the 1950s, it wasn’t until diamonds were sold on the internet that diamond certificates really became mainstream. Prior to the early-to-mid 2000s, it was rare to see certified diamonds in traditional jewellery stores, and even then, they were mostly reserved for larger and/or more expensive diamonds. Moreover, back in these “bad old days”, a lot of jewellers relied on valuations or appraisals, either done by a gemmologist in-house, or an independent gemmologist (paid for by the jeweller of course). This led to wildly inaccurate gradings, with little to no transparency between the jeweller and the customer. Of course, the internet wasn’t popular in those days, so consumers didn’t know any better.

When the internet came along, it was natural that diamond certificates became more popular – after all, online vendors needed something to prove the quality of their diamonds, and very few provided photos or additional analysis for the diamonds they were selling. Soon enough, diamond certificates found their way into brick-and-mortar jewellery stores. However, outside of the USA, GIA wasn’t very popular at first. In Australia, DCLA took the industry by storm, through spending up big on direct-to-consumer marketing, especially on segments on popular network TV current affairs shows such as Today Tonight and A Current Affair. In 2006, when I took over managing Jogia Diamonds, I made a concerted effort to stop selling DCLA certified diamonds, as I believed, either rightly or wrongly, that GIA grading was far stricter than DCLA’s grading. Eventually, DCLA took their marketing too far and they fell out of favour with the industry. This paved the way for GIA’s dominance in Australia, which the industry seemingly embraced.

Fast forward five years and by 2013, GIA had laboratories across the US, the Middle East, Asia and Africa. Internationally, GIA was then, and still is, seen as the “gold standard” of diamond grading, and if that wasn’t enough, popular diamond trading network, Rapnet banned their biggest competitor, EGL in 2014.

The Good, The Bad and The Ugly?

The benefit of having one grading laboratory dominant throughout the trade is that it creates a de-facto industry standard, hence disputes, both within the trade and with consumers are rare. It is also beneficial for consumers, as consumers are easily able to compare offerings from various retailers very easily, however, some may see this as mere commoditization of the industry.

With benefits inevitably comes downsides, including:

- Any criticism isn’t taken seriously. For example, many pundits knew from day one that GIA’s cut grading system wasn’t up to scratch. Over the years, it seems to have only become worse. In addition to this, I, amongst many in the trade feel that GIA’s clarity grading has become a lot less strict, compared to say 20 years ago.

- Innovation becomes non-existent. Sure, GIA bought AGS laboratories in 2022, but other than that GIA certificates haven’t had a major upgrade since their cut grading system for round brilliants was released in 2005.

- Smaller competitors, that may well offer complementary services to GIA are overlooked by both the trade and consumers. Moreover, the science of gemmology no longer has as much commercial value, and hence there are fewer gemmologists being trained, with wholesalers and retailers much less likely to hire gemmologists.

Perhaps the worst, but unintended consequence of GIA’s dominance is that, as evidenced by Joshua Freedman’s video, the industry is now full of NPCs who have no real knowledge of diamonds and merely read off the GIA certificate and what their bosses tell them to say. From a consumer’s perspective, this means that a lot of diamonds are being manufactured, and hence sold, that look good on the certificate, but don’t necessarily look that great in real life.

Above: A new batch of LVMH and Richemont employees?

Stepping Out of the GIA NPC Mold

Despite their shortfalls, GIA are really good at grading colour and clarity. I do feel that if GIA were not as dominant, we would have a situation whereby smaller labs would either attempt to replicate GIA’s colour and clarity grading, spend huge amounts of money on marketing to mask their lax grading or simply go out of business. That would be an absolute mess. However, the GIA certificate only provides basic information about the diamond and there are many other factors beyond what GIA grade such as lustre (transparency), hue, diamond origin, effects of inclusions and of course the cut quality of the diamond.

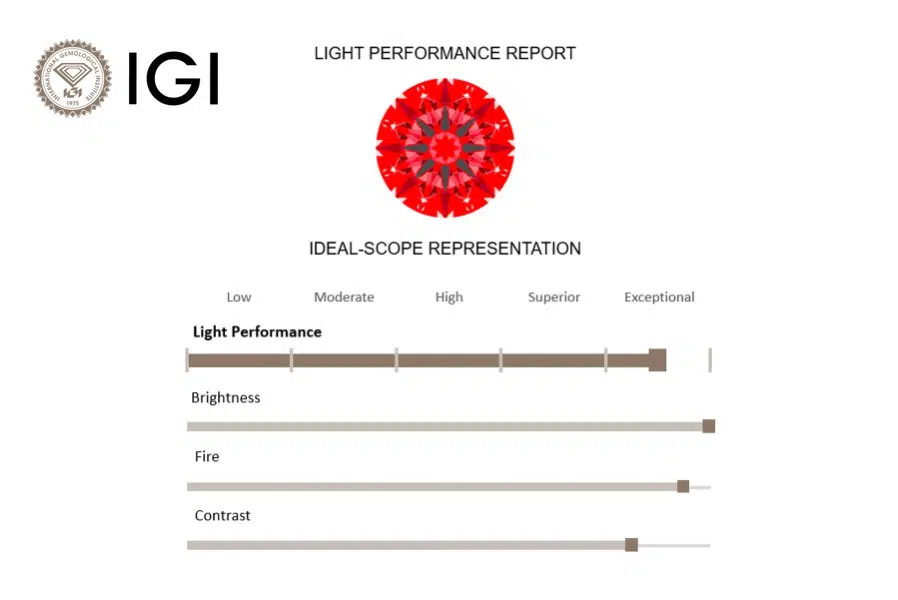

Whilst the factors listed above can be subject to one’s opinion, a more objective factor for retailers to market themselves over and above the GIA certificate is cut quality. GIA are, and have always been terrible at this. Although their recent AGS acquisition allows them to use AGS technology – no one in the industry uses it. Tools such as reflectors (Ideal-Scope, ASET and hearts and arrows scopes) and even additional certification from the likes of GCAL allow retailers to stand out from the crowd when selling GIA certified diamonds.

Above: IGI have started using raytraced Ideal-Scope reports.

Final Thoughts

At the end of the day, most jewellers are selling finished products, whether it be an engagement ring, wedding ring, pendant or earrings. However, the diamond is by far the most valuable part, thus it is important for salespeople to not only have in-depth knowledge and experience to advise their customers, but also the ability to differentiate themselves from everyone else who is pretty much selling the exact same product.