Most professionals in the diamond industry would agree that diamond grading has slowly become worse over the past 20 years. In fact, if you offered me a choice of two round brilliant diamonds, the same size, colour, clarity and proportions, with one graded by GIA in 2003 and another graded in 2023, it would be a no-brainer to choose the one graded in 2003, as I have witnessed firsthand what I think to be the slow degradation of grading standards, in some cases such as the GIA cut grade it is on display for the whole world to see. However, people rarely talk about this. Sure, there have been and will always be disputes about diamond grading, but it seems nowadays, the entire industry, from wholesalers and retailers to independent valuers simply accept GIA’s grading without any questions.

GIA’s “Closed Loop” System

Over the past 10 years, GIA’s market share of diamond grading has grown to a point to whereby most in the diamond industry would agree it is a monopoly. Robert James of The International School of Gemology (ISG) labelled GIA’s dominance as such back in 2020. However, Robert also alludes that GIA not only has a monopoly on diamond grading, but also the gemmological education market – that is training would be graders and gemmologists who work not only in GIA’s laboratories, but throughout the diamond supply chain from manufacturers to retailers. This therefore gives GIA absolute control, or a “closed loop” system when it comes to grading both in their own laboratories and the broader industry itself. This, as Robert James, says, is detrimental to the industry as superior gemmologists are often overlooked in favour of GIA trained gemmologists, who may not possess the diversity of knowledge or experience that a non-GIA trained gemmologist has.

Above: A GIA grader

Fraud, Bribery and Negligence

It should come as no surprise that, given the high value of gemstones that GIA grades, there have been a couple of instances of fraud and bribery. Also, given that gemstones are graded and handled by humans, mistakes are bound to occur. However, over then past twenty years, only three cases made headlines in the industry:

- GIA’s bribery scandal in 2005, whereby a GIA laboratory employee was bribed in order to give a higher grade. This claimed the scalp of then GIA president Bill Boyajian.

- GIA’s HPHT mis-grading in 2013 involving a 4.80 carat emerald cut diamond originally graded as natural and without treatment, but then when sent back to GIA for verification, was graded as HPHT treated.

- In 2015, employees of GIA’s contractor, Tata Consultancy Services, hacked GIA’s database and altered grading reports. GIA did identify the reports, offered to verify them for no charge and offered a free confirmation service for months after the event happened.

Above: GIA’s bribery scandal tarnished their reputation

There have been many other smaller incidents, most of them involving fraudulent GIA certificates. However, with millions of diamonds graded and reports issued each year, it is clear that fraud, bribery and negligence, whilst it may exist, isn’t a problem that diamond buyers should worry about when buying a GIA certified diamond, especially when you buy from a trusted and reputable seller.

The 2005 bribery scandal was the first time GIA’s reputation had been tarnished. This caused some in the industry to use this incident as justification as to why GIA couldn’t be trusted – usually in tandem with promoting their own products or grading laboratory. The aforementioned Robert James of ISG wrote:

“It is a well documented fact that diamond graders at the GIA have been caught selling higher certificate grades to large diamond dealers who use their services. The GIA certificate system world-wide is so porous that there are stories on record of their certificates getting changed by internal employees to give higher diamond grades to select dealers using the GIA lab. To this day, those four GIA New York diamond graders caught selling high grades to dealers have never been exposed and never been prosecuted.”

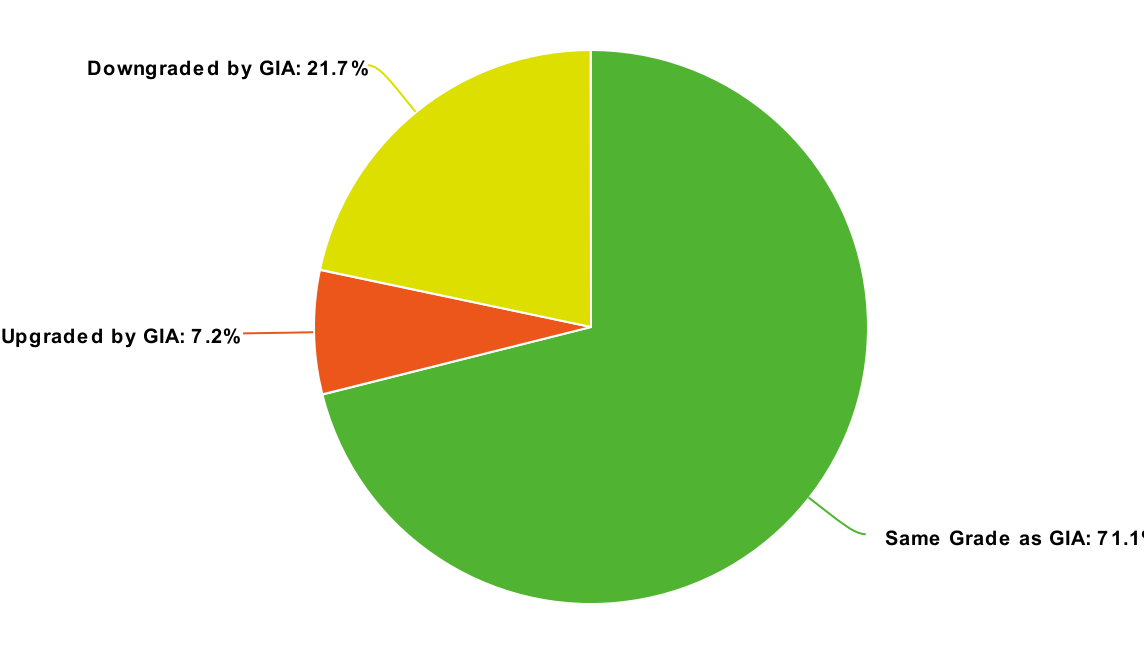

This sort of statement is typical from a member of the “anti-GIA army”, whose numbers have dwindled to almost zero since they formed on the back of the 2005 bribery scandal. The fact is that Mr James has no proof that such fraud exists and is as widespread as he makes it out to be. In fact, a quick check on the stock of colourless, VS clarity, one carat diamonds of one of the world’s largest diamond manufacturers, reveal that, compared to the manufacturer’s grade, the GIA grade was the same in 71% of diamonds, downgraded in 22% of diamonds and upgraded in only 7% of diamonds.

Above: Results of a survey of 1ct diamonds from a large diamond manufacture

What About Smaller Labs?

There’s a saying in the industry that no other lab can afford to grade as strict as GIA, meaning that in order to remain in business, smaller labs must issue “looser” or higher grades than the GIA would, thus keeping their clients, who are retailers and wholesalers happy. Whilst there are a few diamond grading labs in Australia, such as DCLA, Auscert and GSL, diamonds graded by these labs are somewhat of a rarity nowadays. That’s not to say their grading isn’t as good as GIA, or that they routinely issue “upgrades” on diamonds they grade. Moreover, I think GIA has become so monotonous, that it doesn’t make financial sense for an Australian based diamond wholesaler or retailer to import uncertified diamonds and then have them certified locally. In addition to this, none of these labs have made a compelling case as to why people should use their certification services.

GCAL, now owned by diamond manufacturing and analysis equipment maker Sarine, bills itself as the grading industry’s David opposed to GIA’s Goliath. Looking through their services, they do indeed make quite a compelling case to use their grading services, and offer services such as:

- Light performance analysis, including symmetry, hearts and arrows and brilliance analysis using a number of different methods.

- “Diamond Journey” analysis.

- Photography

- A grading guarantee

Clearly GCAL’s products more or less complement the GIA grading certificate, rather than try to compete (and end up losing) with GIA’s grading reports. I would say that GCAL’s model would be the best for any smaller lab, as competing with GIA will always be a losing battle, relegating smaller labs to private clients (members of the public) and lower quality jewellery stores.

Automated Grading

Automated or machine-based grading, whilst sounding like a silver bullet, has been around for decades. However, even today, in 2023, it is still far from perfect. In 2021, an industry panel agreed that machines would be unlikely to replace humans grading diamonds. Funnily enough, when I wrote about automated grading a few months ago, I wrote that De Beers was using a machine called “Eagle” to grading clarity. Now it seems they have removed all references to the Eagle machine, a move that most likely means that it wasn’t so great and thus is not in use anymore.

So Can You Trust Diamond Grading Certificates?

The simple answer is yes – if you buy from a reputable seller, or seek advice from an independent expert when buying a diamond, you should have the upmost confidence in a GIA certificate. Whilst their grading has noticeably deteriorated over the past 20 years and monopolies are never a good thing, GIA still remains the gold standard all over the world. Whilst you may seek to have extra services such as light performance grading and grading verification done by a smaller laboratory, these services can also be performed by the vendor, provided they have the right equipment and expertise.