Almost universally, the past three years have been terrible to say the least for the diamond industry. However, as a new year is upon us, many in the industry are optimistic that the worst has passed, and things will start getting better. However, whilst there is cause for optimism, my predictions for the year may seem far less optimistic.

The Wholesale Lab Grown Diamond Market will be Relatively Stable

I began this year by writing about how lab grown diamond prices had plummeted over the preceding year, and predicted they would fall to the region of US$50 per carat in the near future. However, prices of lab grown diamonds have remained relatively stable over the past few months. This is good news for both manufacturers and retailers, and frankly, anyone in the remotely associated with the lab grown diamond industry.

Whilst I have previously stated that the lab grown industry needs to change in order to reflect the value of the product, such doing away with grading certificates from independent labs such as IGI and even creating an entirely new grading scale to differentiate them from their natural counterparts, I don’t think any meaningful changes will be made this year, hence severely restricting manufacturers ability to lower prices.

What I do predict however, is that larger lab grown diamonds will be more prone to price falls. At the moment, a six carat round brilliant lab grown diamond costs more than twice per carat than a two carat one. However, unlike natural diamonds, which are priced based on rarity, it is inherently less expensive on a per carat basis to grow and manufacture a six carat lab grown diamond than a two carat one.

View this post on Instagram

Above: 5ct and above lab-grown diamonds will see significant price drops this year.

Natural Diamond Prices will NOT Stabilise

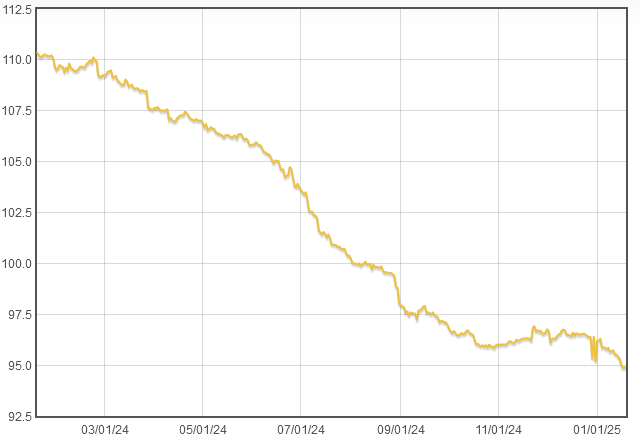

There’s a common thought amongst many in the industry that natural diamond prices are stabilising after a decline of close to 40 percent over two and a half years. Unfortunately, this so-called “stabilisation” has only occurred over the past two months of the year, when diamond demand is at its peak due to Christmas and supply being tempered by Diwali holidays in India. A quick look at the IDEX Diamond Price Index, shows prices have continued their decline in the first two and a half weeks of the year, declining by over one percent.

Above: The IDEX price chart showing falls at the start of 2025. (Source)

Whilst demand will pick up slightly over the year for various reasons, such as more people getting married after the COVID-induced hangover, and lab-grown diamonds losing their lustre in albeit low-end engagement rings, demand levels are nowhere near 2019 levels, and diamond miners are still sitting on large stockpiles of rough. This all points to continuing price declines, in the order of 10 to 20 percent over the course of 2025.

GIA Will Cease to Grade Lab Grown Diamonds

It is fair to say that GIA has been absolutely slaughtered by competitor IGI in the lab grown diamond market. With lab grown diamond prices falling significantly over the past three years, the cost of certification now makes up a significant portion of the total cost of the diamond. IGI, the dominant player in the field, have used so-called in-factory grading in order to keep labour costs down. However, it is fair to say that hell will need to freeze over for GIA to do anything remotely close to “in-factory grading”. Unable to compete with IGI, and faced with dwindling demand for their lab grown diamond reports, I predict GIA will cease grading lab grown diamonds sometime in 2025 – a move that will be welcomed by more conservative members of the trade, many of whom think GIA should never have started grading lab grown diamonds.

Above: GIA may only grade natural diamonds soon.

Someone Will Disrupt the Retail Lab Grown Diamond Market

Whilst more competition has eroded retail margins on lab grown diamonds, compared to natural diamonds, margins on lab grown diamonds are still many times more, usually by a factor of between three and ten times. Plus, the capital and expertise needed to sell lab grown diamonds is negligible compared to natural diamonds. It therefore wouldn’t be surprising that we see a new entrant, not necessarily jewellery related, see this opportunity and quickly establish themselves as a dominant player in the market and go on to disrupt the retail lab grown market. Candidates for these new players could be:

- A big box store like Walmart or Costco.

- An Indian or Chinese conglomerate opening a chain of stores.

- A multi-brand company like Signet opening new stores dedicated to lab grown diamond jewellery.

- A “tech bro” realising the profits that can be made from lab grown diamonds, and no doubt using some AI-gimmick to lure customers.

Above: I’m assembling a team to disrupt the retail lab grown diamond industry…

Unfortunately, some jewellery retailers are addicted to margins on lab grown diamonds, and just like drug addicts, taking these margins away will never end well.

The Russia Conflict Will End…and the Diamond Industry Will Act Like Nothing Ever Happened.

At some point in time, the conflict between Russia and Ukraine, now entering its fourth year, will come to an end. Many of Donald Trump’s fans think, perhaps wishfully, that his re-instatement as President will be the catalyst for its resolution. Whenever it does end, it can be almost guaranteed that the diamond industry will welcome Russia back to the international diamond trade with open arms as if nothing ever happened.

Just as the industry did with in the early-2010s, in response to sanctions, diamonds cut from rough originating in Zimbabwe were shunned, most notably from diamond-tzar Martin Rapaport’s diamond trading network, Rapnet. However, over the proceeding years, sanctions were lifted, and Zimbabwean diamonds were no longer seen as “dirty”, despite Robert Mugabe still being in power.

Above: Dictator Robert Mugabe

With controversy surrounding the social impact of diamonds being well reported on in the preceding years, and the Kimberley Process being established in 2003, Zimbabwe should have been a wake up call to the industry to establish proper country of origin tracing. However, quite predictably, nothing was done. Likewise, it would seem no industry-wide country of origin tracing is likely to be implemented any time soon. Sure, there have been some proposals, and DeBeers has implemented Tracr, a diamond traceability platform, but there hasn’t been any industry-wide agreement on the issue.